Washington state is not just a place on the map; it’s a mosaic of breathtaking landscapes and diverse environments. On the West side you can wake up surrounded by towering evergreens, hear the soothing patter of raindrops on your window, and feel the cool mist from nearby waterfalls—all before breakfast. But hop in your car and drive a few hours in the other direction, and you’ll find yourself in a completely different world: rolling hills bathed in warm sunlight, orchards bursting with seasonal fruit, and a sense of tranquility that’s uniquely our state.

As a real estate agent deeply rooted in this vibrant region, I’ve had the privilege of helping clients discover the magic of living west and east of the mountains. There’s something truly special about that short, beautiful drive east over the pass—a journey that not only changes your scenery but also your state of mind. The pace slows, the air feels lighter, and you’re enveloped in a sense of laid-back serenity that’s hard to find anywhere else.

But amidst this idyllic backdrop lies a sobering reality: the ever-present danger of wildfires. What was once considered primarily a “East of the mountains problem” has now become a concern that touches communities across the state.

As we enter another fire season in Washington State, homeowners face a pressing concern: insurance coverage. Over the past few years, the insurance industry has been tightening its grip on policies for properties located in designated fire zones, regardless of whether they are primary residences or second homes. This leaves many homeowners feeling vulnerable and uncertain, searching for solutions to protect their cherished investments and beloved communities.

Insurance companies are reevaluating their risk exposure in fire-prone regions, leading to the unfortunate scenario of skyrocketing rates or dropping clients in some areas. For homeowners, this abrupt change can be unsettling and leaves them scrambling to find adequate coverage elsewhere.

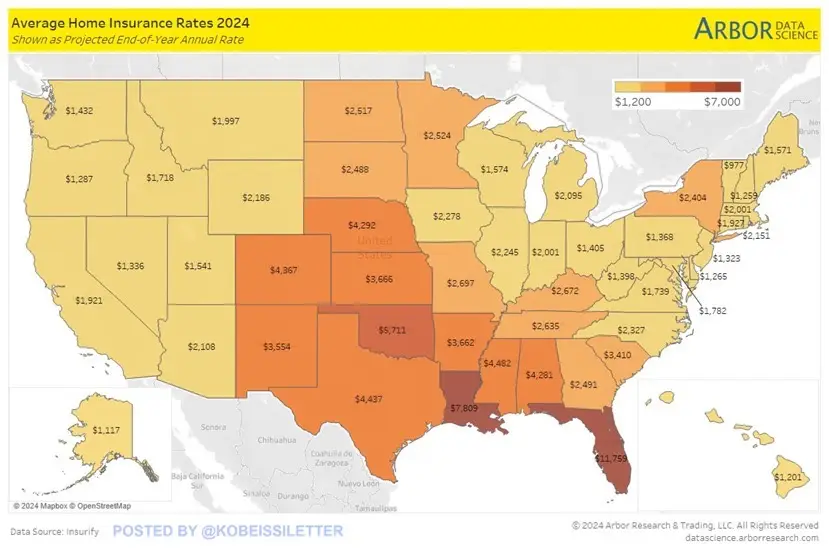

Homeowners insurance premiums across the nation are rising, and Washington state hasn’t been immune to this trend. In just the past year, we’ve seen average premiums for new homeowners jump from around $95 per month to $125—and in some cases, closer to $200 per month. This shift not only impacts homeowners’ monthly budgets but can also impact loan approvals, as lenders factor in debt-to-income ratios. Be sure to check with your lender when purchasing a new home to confirm that rising insurance costs are being considered.

These changes are even more pronounced in high-risk areas. Washington homeowners, especially in fire-prone zones, are facing tough questions about coverage availability and affordability.

Shop Around: While some insurers may be withdrawing coverage, others are still willing to provide policies. It’s essential to explore multiple options and compare coverage and rates.

Specialized Policies: Look for insurers specializing in wildfire coverage. These companies often have tailored solutions for properties in high-risk areas.

Mitigation Efforts: Take proactive steps to mitigate wildfire risk on your property. Installing fire-resistant materials, maintaining defensible space, and having an evacuation plan can all contribute to lowering insurance premiums and improving insurability.

Government Programs: Investigate government programs aimed at assisting homeowners in fire-prone regions. Some states offer incentives for mitigation efforts or have programs specifically designed to provide insurance coverage in high-risk areas.

Consultation with Experts: Seek guidance from insurance brokers or agents familiar with the challenges of insuring properties in fire zones. They can provide valuable insights and help navigate the complex insurance landscape.

Beyond wildfires, homeowners should also consider coverage for other natural disasters common to the region, such as earthquakes and floods. Here are steps to ensure comprehensive protection:

Review Policy Limits: Make sure your policy adequately covers the replacement cost of your home and belongings. Consider endorsements or additional coverage for high-value items or specialized assets.

Understand Exclusions: Familiarize yourself with the exclusions in your policy. Some insurers may exclude certain perils, necessitating additional coverage or endorsements.

Document Valuables: Keep detailed records and documentation of your possessions. This information can streamline the claims process in the event of loss or damage.

Regular Policy Reviews: Periodically review your insurance policy to ensure it reflects any changes to your property or circumstances. Update coverage as needed to maintain adequate protection.

Washington State Firewise Program: This program provides guidance on creating defensible space and reducing wildfire risks around your property. More information is available on the Washington Department of Natural Resources website.

Washington FAIR Plan: The Fair Access to Insurance Requirements (FAIR) Plan offers basic property insurance for those who cannot obtain coverage in the standard market, especially in high-risk areas. Details can be found on the Washington FAIR Plan website.

FEMA Disaster Assistance: The Federal Emergency Management Agency (FEMA) provides various assistance programs for disaster preparedness and recovery. Explore available resources on FEMA’s website.

Navigating homeowners insurance in fire-prone areas can be challenging, but it’s not insurmountable. By being proactive, exploring options, and understanding your coverage needs, you can safeguard your home and belongings against the uncertainties of wildfire season and other natural disasters.

Remember, preparation is key. Take the necessary steps today to ensure you’re adequately covered tomorrow.

I think it goes without saying, whenever you get a chance thank the firefighters and first responders who brave the line of fire to protect our homes and lives. Stay safe and prepared, we all have to look out for each other!!

Hey there! I’m Maureen, a community blogger and Real Estate Broker at American Classic Homes Real Estate in the Pacific Northwest. Here to help you find your perfect home and share tips on living your best life in the PNW. Let’s come home together to the Pacific Northwest!

Unveiling Pacific NW Bests and Real Estate advice so you never miss a thing!

(Hover over photo for Title)

(Hover over photo for Title)

For a daily dose of home inspiration, real estate insights, and community updates. Join our vibrant online community and be part of the conversation!

Stay in the loop, share your thoughts, and let’s continue building connections beyond the blog. Your journey to inspired living starts here!